In an era of rapid economic shifts, simply saving money may not be enough to secure your financial future. Inflation erodes purchasing power, and low interest rates mean your money isn't growing. Investing allows your money to work for you, potentially outpacing inflation and building wealth. While investing can seem complex, this guide will demystify it for beginners. We'll cover core concepts, goal setting, investment vehicles, and a step-by-step roadmap to building your first portfolio, helping you confidently navigate the investment landscape in 2025.

II. Understanding the Basics: Key Investment Concepts\

Understanding fundamental concepts is crucial for smart investing.

What is Investing? (vs. Saving)

Saving is setting aside money for short-term goals, prioritizing preservation and access. Investing is committing money to assets with the expectation of long-term growth, involving higher risk but greater potential returns.

Risk and Return: The Fundamental Trade-off

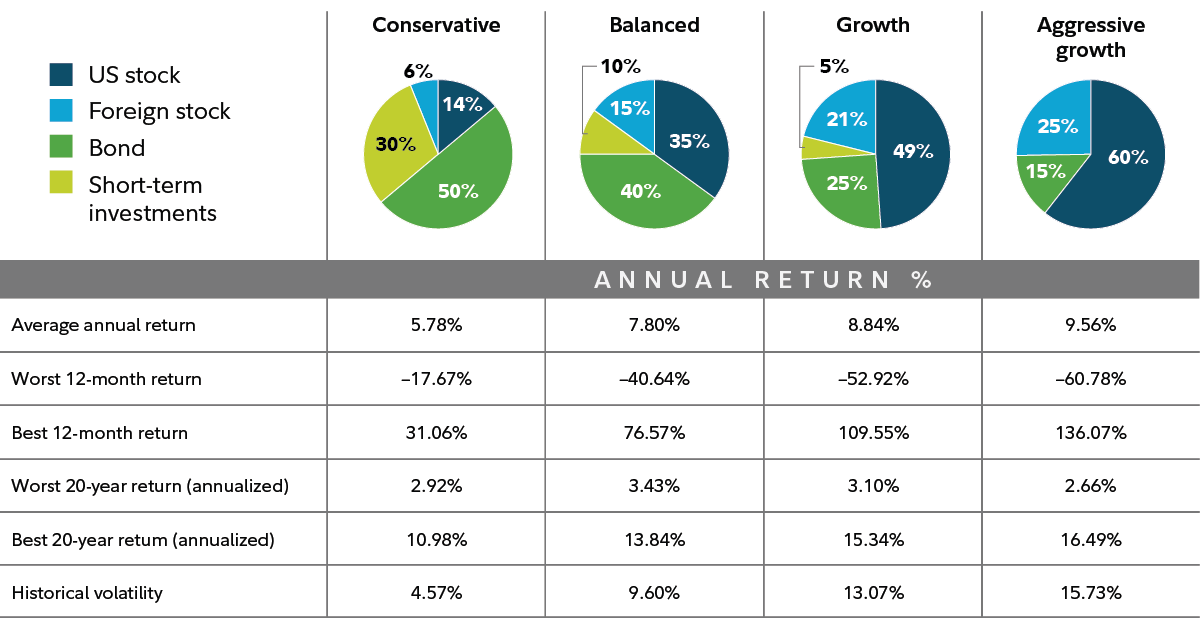

There's a direct relationship between risk and return: higher potential returns typically come with higher risk. Understanding your personal risk tolerance is vital for choosing appropriate investments.

Diversification: Don't Put All Your Eggs in One Basket

Diversification minimizes risk by spreading investments across various assets. This includes different asset classes (stocks, bonds), within asset classes (various industries), and investment styles. When one asset performs poorly, others may perform well, stabilizing your portfolio.

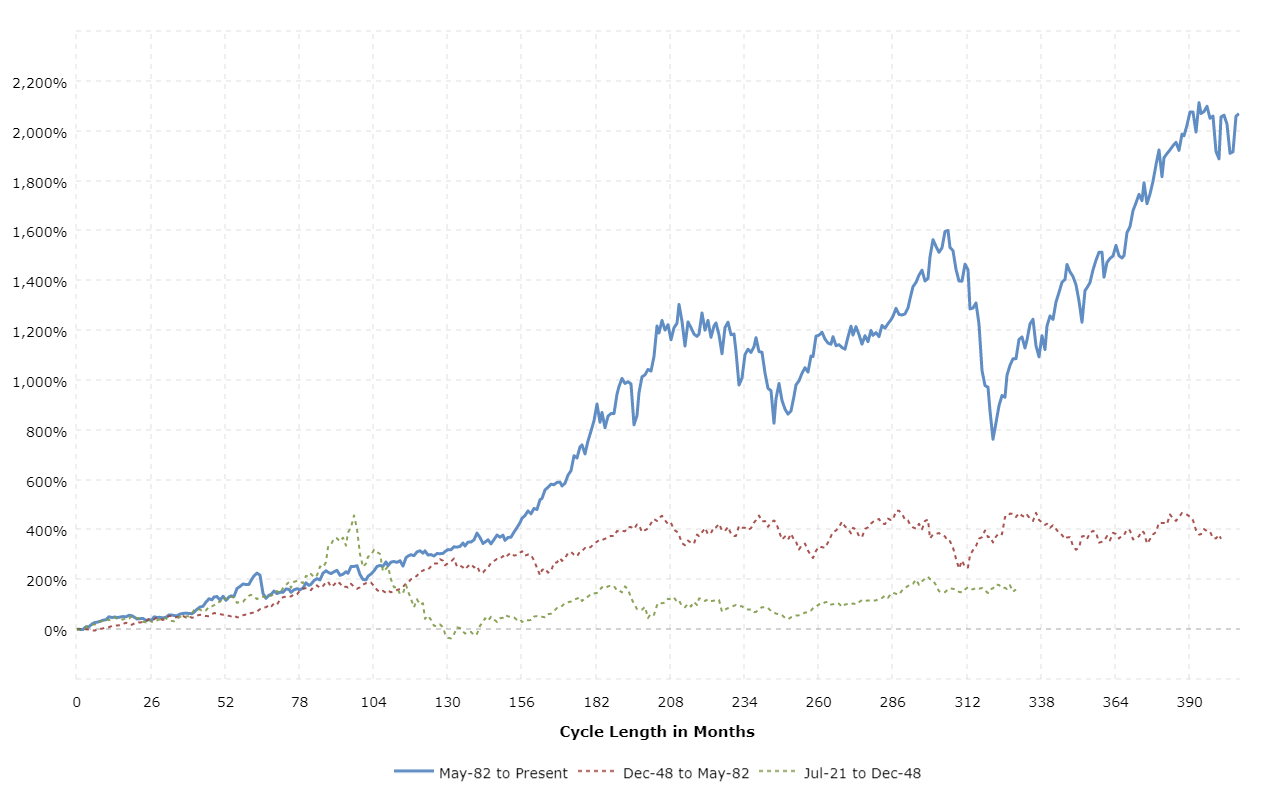

Compounding: The Magic of Growth

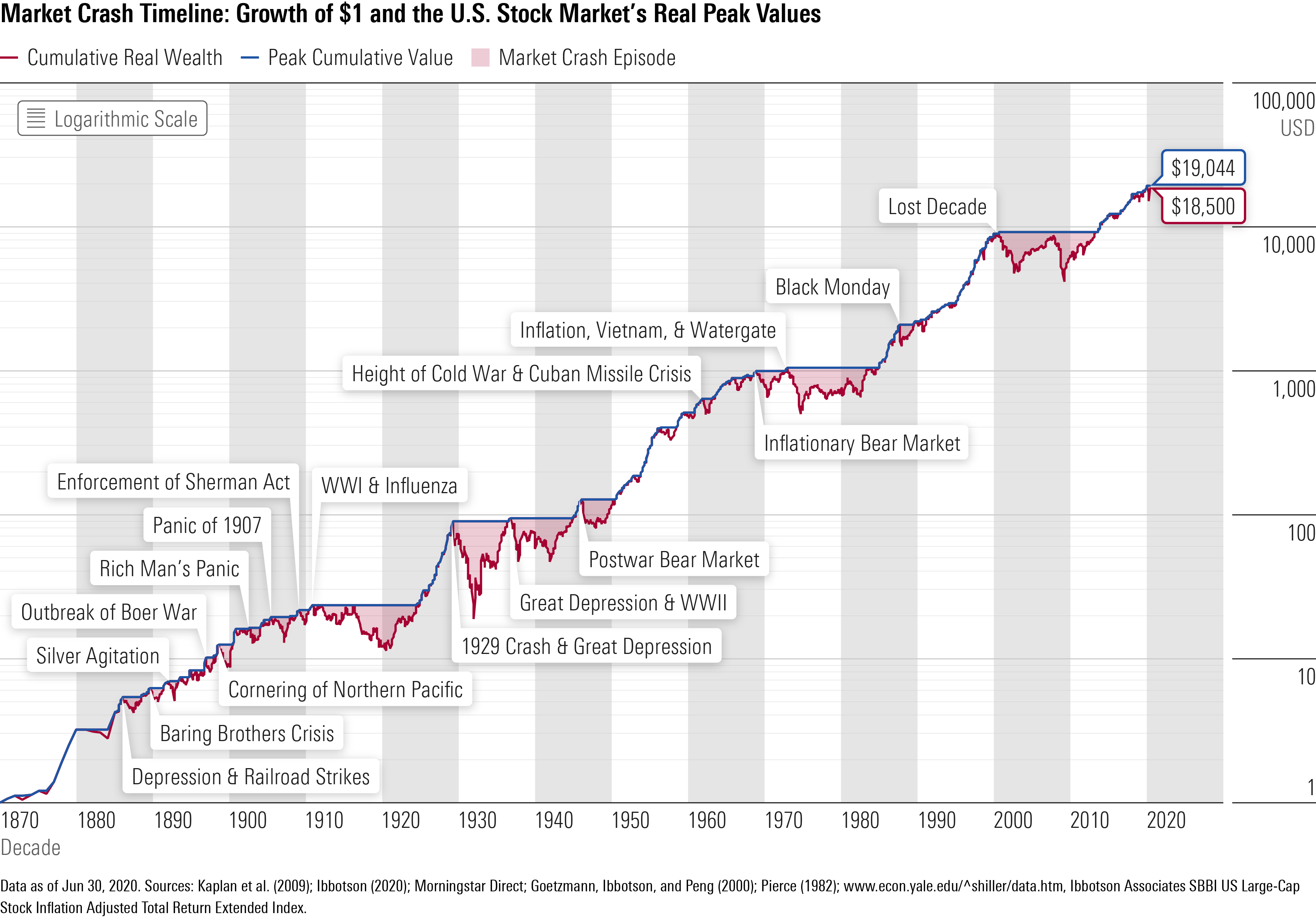

Compounding is earning returns on your returns. Reinvesting earnings allows your money to grow exponentially over time, making time your most powerful ally in investing.

III. Setting Your Investment Goals for 2025

Defining your investment goals is the most crucial step. Clear goals guide your strategy and risk tolerance.

Short-term vs. Long-term Goals

•Short-term (1-5 years): For goals like a car or vacation, prioritize capital preservation with lower-risk investments.

•Long-term (5+ years): For retirement or education, you can take on more risk, as market fluctuations tend to even out over longer periods.

Defining Your Financial Objectives

Be specific: "Save $50,000 for a house down payment in 3 years" rather than "save money." Common objectives include retirement, education, major purchases, and financial independence.

Assessing Your Risk Tolerance

Your risk tolerance is your comfort level with potential losses. It's influenced by age, income, and psychological comfort. Be honest about whether you're conservative, moderate, or aggressive, as this will shape your portfolio choices.

IV. Popular Investment Vehicles for Beginners in 2025

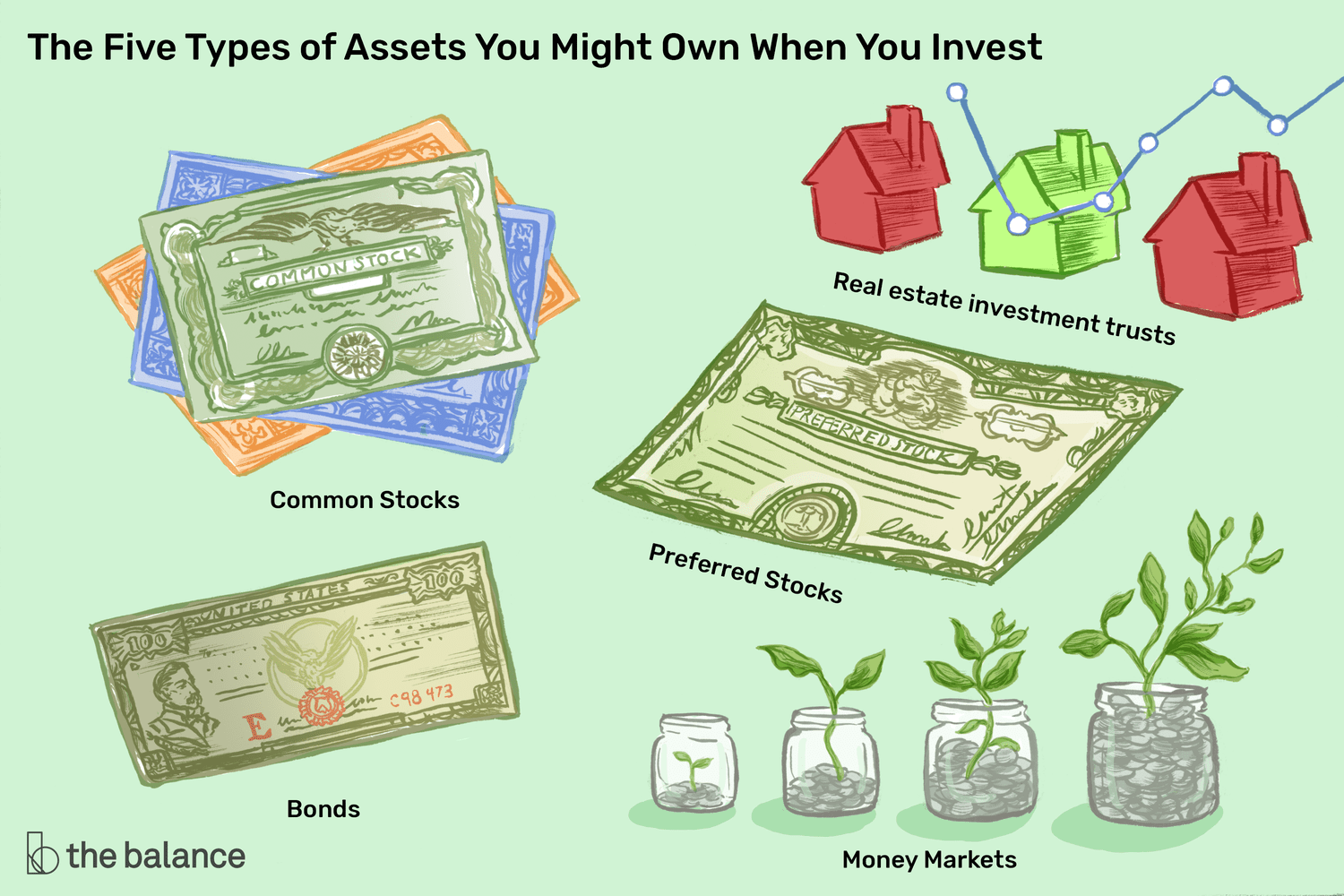

Here are core investment options for beginners:

Stocks: What They Are and How They Work

Stocks represent ownership in a company. Their value can increase with company growth, and some pay dividends. While offering high return potential, they are volatile. For beginners, diversified approaches are often better than individual stock picking.

Bonds: Stability and Income

Bonds are loans to governments or corporations, providing regular interest payments. They are generally less risky than stocks, offering stability and steady income, though with lower returns.

Mutual Funds and ETFs: Diversification Made Easy

Mutual Funds and Exchange-Traded Funds (ETFs) are professionally managed collections of securities. They offer instant diversification and professional management, making them ideal for beginners. ETFs trade like stocks, while mutual funds are bought at day's end NAV.

Real Estate (briefly, e.g., REITs for beginners)

For real estate exposure without direct property ownership, Real Estate Investment Trusts (REITs) trade on exchanges, offering liquidity and potential income.

Emerging Investment Trends for 2025

Consider Sustainable Investing (ESG) for aligning values with investments, and ETFs focused on specific tech sectors like AI or renewable energy. Digital Assets (cryptocurrencies, NFTs) remain highly volatile and speculative; caution is advised for beginners.

V. Building Your First Portfolio: A Step-by-Step Guide

Building your portfolio can be broken down into manageable steps:

Step 1: Open a Brokerage Account

Choose an online brokerage (e.g., Fidelity, Vanguard) with low fees, no minimums, and good resources. This account allows you to buy and sell investments.

Step 2: Start with a Budget and Emergency Fund

Before investing, ensure financial stability: create a budget, build an emergency fund (3-6 months' expenses), and pay down high-interest debt.

Step 3: Choose Your Investment Strategy

•Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, regardless of market price. This averages your purchase price and reduces market timing risk.

•Index Fund Investing: Invest in funds that track broad market indexes (e.g., S&P 500) for instant diversification and typically lower fees.

Step 4: Monitor and Rebalance Your Portfolio

Periodically review your portfolio (e.g., annually) to ensure it aligns with your goals. Rebalancing involves adjusting asset allocations back to your target percentages, which helps manage risk and can enhance returns.

VI. Common Pitfalls to Avoid

Avoid these common mistakes to protect your investment progress:

Emotional Investing

Don't let fear or greed drive decisions. Stick to your plan, focus on the long term, and avoid daily portfolio checks.

Chasing Trends

Resist the urge to jump into popular investments after they've already surged. Focus on fundamental value rather than fleeting popularity.

Not Diversifying

Putting all your money in one place is risky. Diversify across asset classes, industries, and geographies.

Ignoring Fees

Fees erode returns over time. Choose low-cost funds and brokerages with transparent fee structures.

Lack of Patience

Investing is a marathon. Wealth building takes time. Stay consistent and understand that market cycles are normal.

VII. Resources and Tools for the Modern Investor

Numerous resources can support your investing journey:

Robo-Advisors

Automated financial planners (e.g., Betterment, Wealthfront) offer low fees, automated diversification, and simplify investment management for beginners.

Investment Apps

Mobile apps (e.g., Fidelity, Robinhood, Acorns) make investing accessible with user-friendly interfaces and micro-investing options.

Financial Literacy Resources

Continuously learn from reputable financial websites (Investopedia, The Balance), classic investment books, podcasts, and online courses.

VIII. Conclusion: Your Journey to Financial Growth

Starting your investment journey in 2025 is a powerful step towards financial security. By understanding core principles, setting clear goals, and utilizing available tools, you can confidently build a robust portfolio. Investing requires consistent effort, patience, and continuous learning. Embrace these principles, avoid common pitfalls, and focus on your long-term objectives. You are not just investing money; you are investing in your future self, building a foundation for financial independence and peace of mind. The time to start is now.